2021 Investment results

7 exits, 11 new private companies and a record year for the pre-IPO market amid new COVID-19 variants, rising inflation and stock market uncertainty.

Public markets

2021 is a make-it-or-break-it year crowned with uncertainty. The global economy was merely beginning to recover from the coronavirus crisis, as new variants emerged, and the world became ready for new lockdowns. Central banks continued to stimulate economies, and the first half of the year saw the rise of major indices, despite the negative situation.

Inflation hit a 40-year high in the second half of 2021 amid the Fed's stimulus measures and growing supply chain problems. The labor market bounced back to normal levels, and the Fed began preparing markets for a monetary stimulus rollback. Meanwhile, major companies on the list of S&P 500 and Nasdaq indices continued to grow: they are profitable, have large cash reserves, lead the markets and influence the ultimate price of their products and services. These factors are favorable in the current environment of rising inflation and tight monetary policy.

The market for fast-growing young tech companies adjusted itself after announcements of reduced asset purchases in November and the upcoming interest rate hike. Investors who want to optimize tax payments before the end of the year also played a role. They are realizing losses in sagging stocks to reduce income taxes in rising stocks.

Uncertainty and volatility gripped the stock market in Q4 2021. One of the main drivers was a new coronavirus variant. Preliminary reports showed it is more contagious but less deadly and could signal the imminent end of the pandemic. The inflation rate in the U.S., which reached 6.8% in November, also added to the uncertainty. A record high in the last 39 years, the Fed stopped short of calling it temporary and acknowledged that supply chain disruptions amid recovering demand will put pressure on prices in 2022 as well.

Following its November meeting, the Fed said it would reduce asset purchases in November by $15 billion from the current volume of purchases of at least $120 billion. In anticipation of a faster interest rate hike, investors began to fix profits on risky tech companies and move into more protective assets. At its December meeting, the Fed tried to reassure the markets and said there would be no hike rate until March 2022.

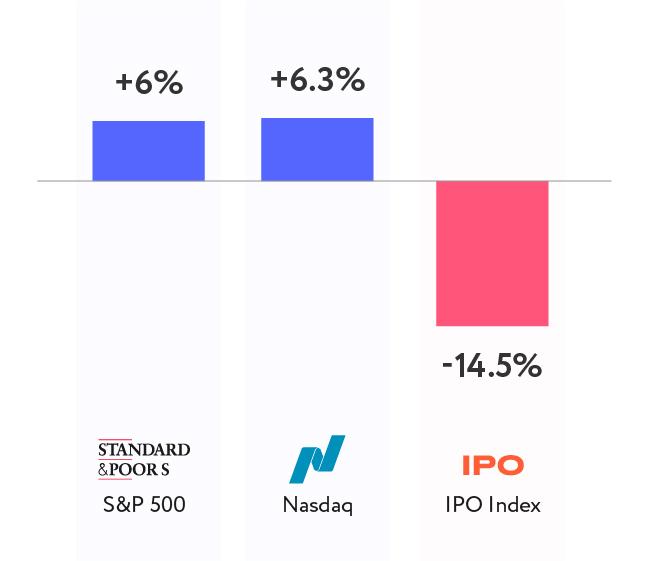

Return on U.S. stock market indices in Q4 2021*

Return on U.S. stock market indices in Q4 2021*

IPO

Amid the high liquidity in 2021, many companies sought to access the public markets, leading to a record number of IPOs. In total, more than 900 new public companies emerged in the market, including over 600 SPACs.

In 2021, we joined 54 IPOs. The average current return, excluding commissions, was +9.3%. The IPO of Global-E Online, Doximity, TaskUs and monday.com showed a return of over 100% per trade. The IPO market index sagged against the leading indices, losing 14.5% since the beginning of 2021.

Rivian’s debut, the U.S. electric automaker, became the world’s biggest IPO of 2021. Although the company is still at the early stage of development and has no revenues, it was valued at $66.5 billion. Other notable offerings include Brazilian neobank Nubank, valued at $41 billion, and Malaysian cab and logistics company Grab, valued at $40 billion.

You can view all IPOs’ results on the UT website.

SPAC

The trend toward flotation through mergers with SPACs, which began in 2020, continued in 2021. In the first three months alone, more companies were debuting as a publicly traded company by merging with a SPAC than throughout 2020.

The frenzy led the SEC to tighten the regulation of such deals, their number significantly decreased, and the market reached its local peak in February 2021. Only in October 2021 companies became active again and the number of SPAC deals began to grow.

At the start of 2021, we offered our clients to invest in 12 SPACs. The average loss on the portfolio is -7%. Two of the SPACs have found their target companies and are preparing to go public. To control the reported risk expectation (10%), we have closed these ideas for investors, since The share price may drop significantly after the deal is completed and the ticker is changed. You can buy the securities in the Stocks and ETF section as soon as the company starts trading under the new ticker.

Pre-IPO

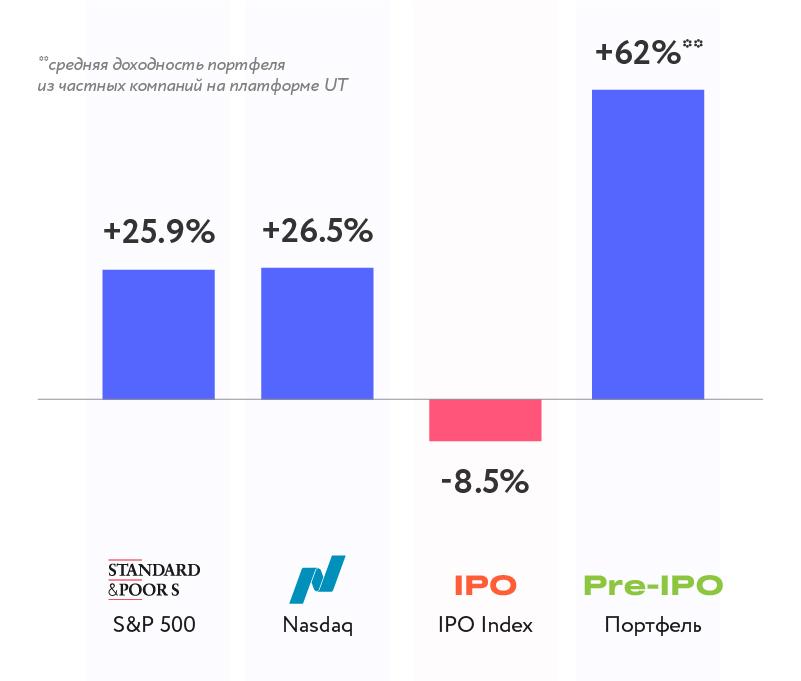

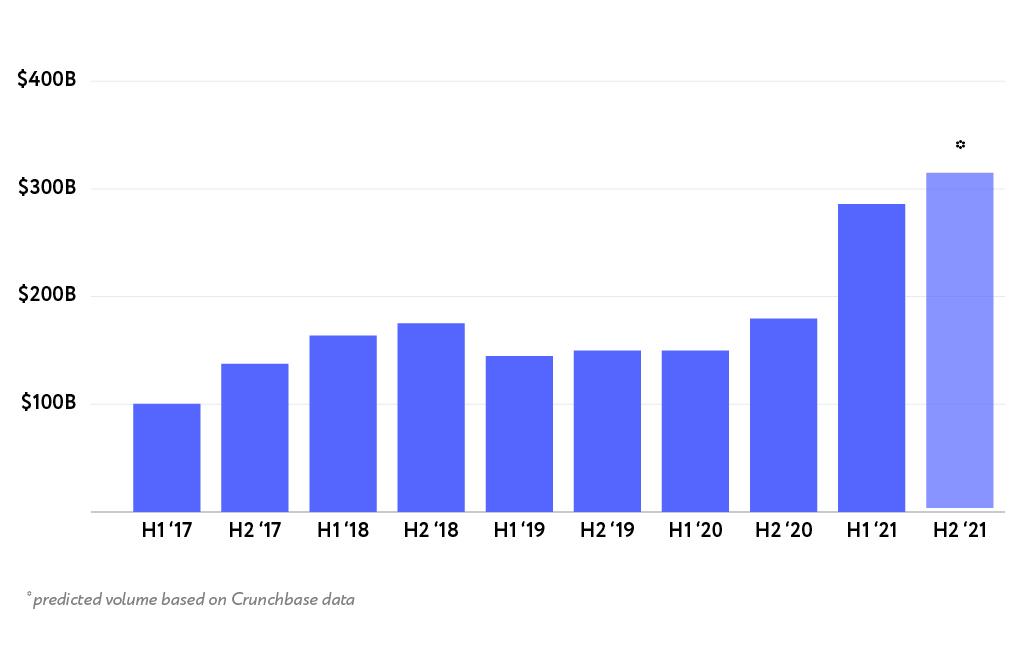

In 2021, the private equity market has shown record results in terms of raised funds and companies’ value growth. At the current pace, the total volume of invested funds in the private market will exceed $600 billion in 2021, up from $334 billion in 2020.

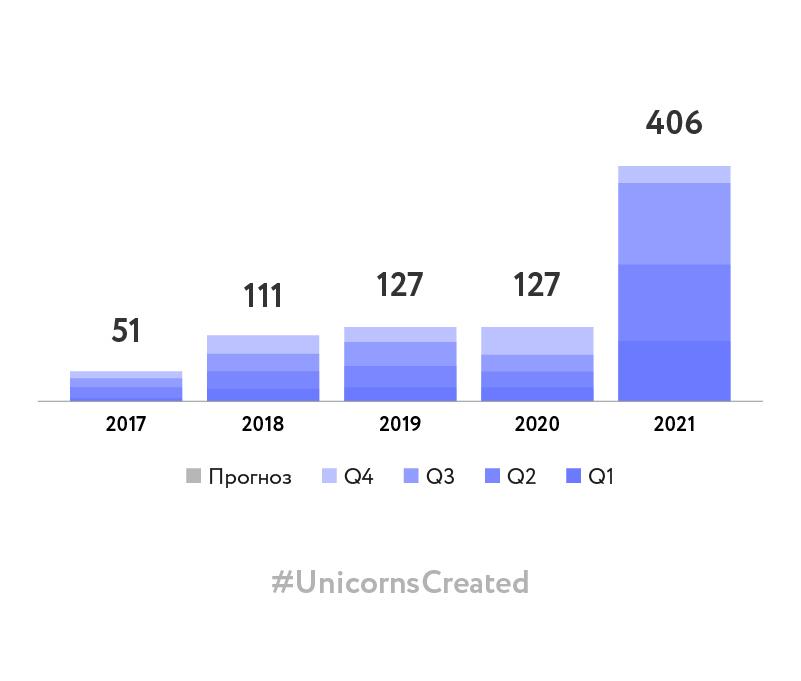

Over 400 companies became unicorns (enterprises valued at $1 billion or more). For comparison, in 2020 there were 127 unicorns. Now there are more than 900 unicorns created in the world.

Can we draw parallels and compare the current rapid growth of private companies to the dot-com crisis of 1999-2000? We believe there are several key differences.

During the dot-com crisis, young companies tried to go public as early as possible. This is evidenced by the record number of IPOs on U.S. stock exchanges in those years – on average, about 600 companies went public every year, which is twice as high as in the past few years.

In 1999-2000, the average age of companies from inception to the debut as a listed company was 4 years. Most of them didn’t have a completed product – investors evaluated these companies based on extremely positive expectations. Now the average age of companies at the time of offering is up to 11 years.

Today private companies stay private for a longer time. Most unicorns can now offer finished products or services and generate substantial revenues. These companies are more prepared to become publicly traded than the young startups of 1999-2000.

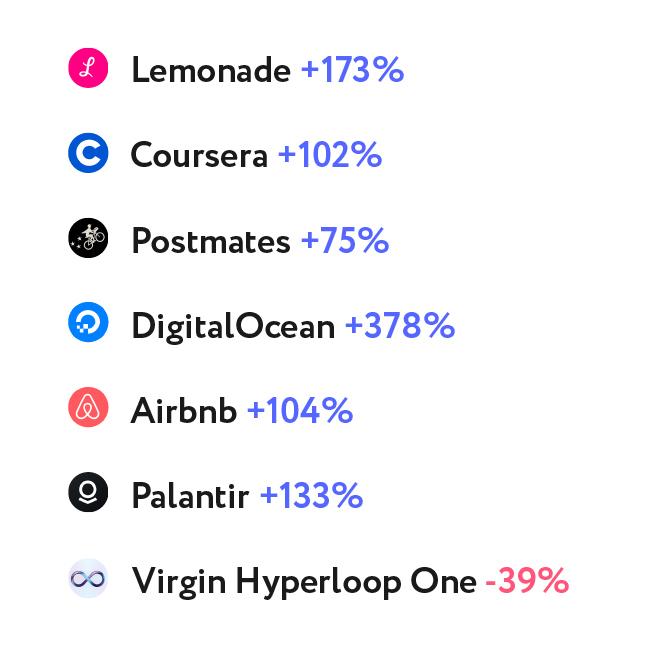

Since 2017 our investors have received access to shares in 42 private companies on the UT platform. In 2021, investments in 7 portfolio companies were completed.

Net return

View the results of all pre-IPO investments

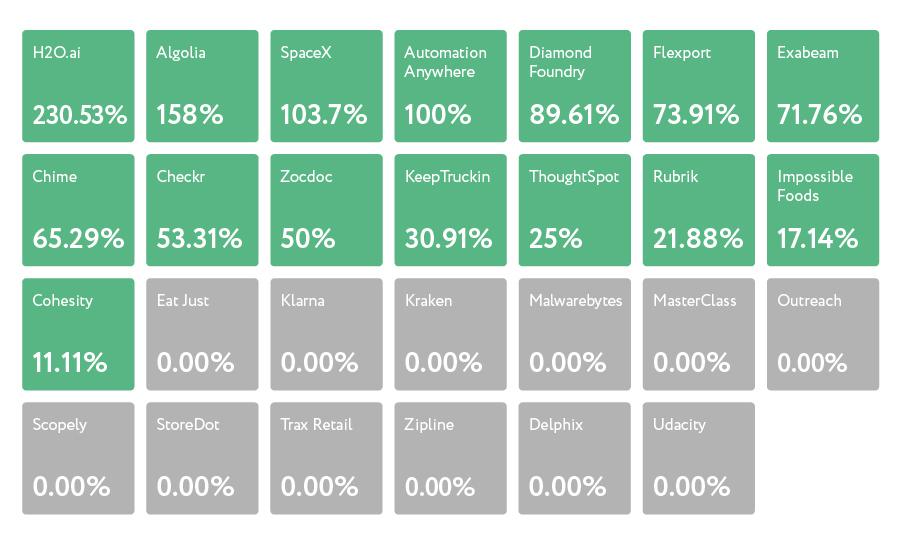

Return on investments in private companies in 2021, excluding commissions

Ginkgo Bioworks, Robinhood, Paragon 28 and Udemy went public in 2021. The final returns will be posted after the lockup period expires and the investments on our platform become closed.

FiscalNote announced that it would go public via a merger with SPAC, a deal that will be completed in the first or second quarter of 2022. In December, 8x8 absorbed Fuze, the details of this purchase will be released in Q1 2022. Cohesity has filed for an IPO with the SEC. The company is expected to go public as early as the first half of 2022.

More news from our companies:

- In November H2O.ai raised $100 million at a valuation of $1.7 billion, the price per share reached $27.50 (+234% to the starting price on the UT platform).

- Shares of Chime, the largest digital bank, rose to $80 (+65%), the valuation reached $28.7 billion.

- Impossible Foods and ThoughtSpot had funding rounds in November and are getting closer to their long-awaited IPO.

- SpaceX's capitalization has reached $100 billion, making it the world's second-largest private company, second only to China's ByteDance (TikTok's owner).

Follow the latest news from private companies

New investment ideas

In 2021, we added 11 new private companies on the platform. Among them are MasterClass, a platform that lets you learn from celebrities, crypto exchange Kraken, artificial meat and egg producer Eat Just, analytics platform for lawyers FiscalNote, leading mobile game maker Scopely, on-demand delivery drone company Zipline, ultra-fast charging battery manufacturer StoreDot, and others.

Expectations from 2022

There are many talented people in the world who are making breakthrough technologies happen and changing the way we think about the future. We sincerely believe that everyone should have access to innovation and participate in the growth of companies that are working on such technologies.

We will continue to provide access to the world’s top private companies – those that are turning traditional markets around, creating their own and bringing substantial returns to their investors.

In the new 2022 year, our investors will have even more opportunities. Dizraptor, an app for investing in private companies from $10,000, is coming soon. It will be as easy to use as the UT app. All deals will be performed through an SPV, a transparent stock ownership structure protected by U.S. law.

We wish you health and prosperity in 2022! Thank you for staying with us!